Book highlights

Fact: 90% of wealthy families will FAIL financially within just three generations.

Why does this happen?

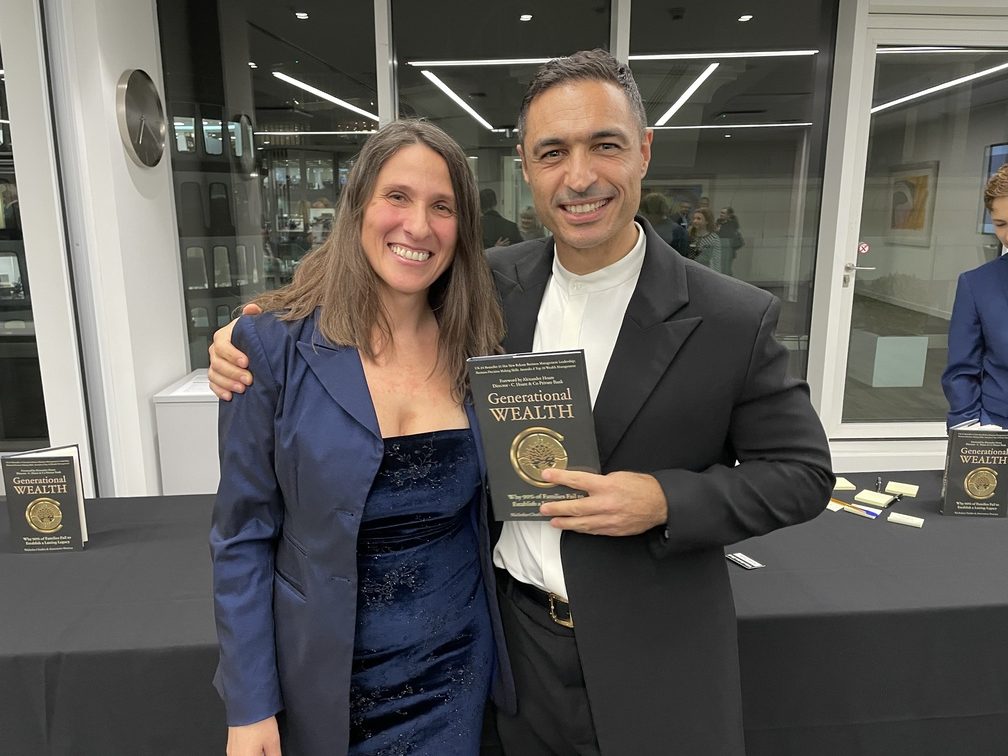

Two UK based family wealth experts, accountant, Nicholas Charles, and private client lawyer, Antoaneta Proctor, have combined their knowledge, experience, and expertise to create this incredible book – Generational Wealth. Their sole purpose is to communicate the real, highly predictable reasons why most wealthy families suffer generational financial failure. Generational Wealth carefully explains the philosophy, strategies and steps required to solve a conundrum that has cursed most wealthy families.

The problem is NOT traditional professional advice. Tax, legal, financial, and structural advice may be important, but they are not fundamental when it comes to sustaining multi-generational financial success. Packed with real life stories and case studies, this book asks the important questions that your family will need to answer if you wish to keep your wealth in the family for generations to come.

Generational Wealth requires you to understand the problems faced by your family today; to have a clear vision of where your family wants to be in the future and to work consistently and collectively, as a family, towards achieving your collective vision.

This is the ultimate guide on how to retain your family’s wealth and establish a legacy that thrives for multiple generations and an impeccable resource.

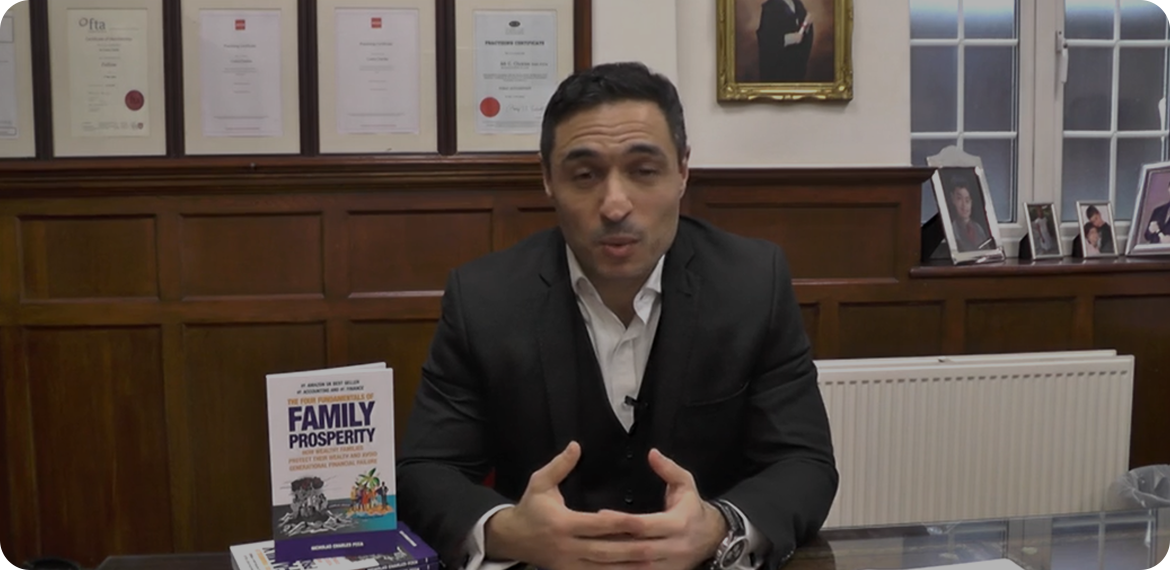

Nicholas Charles FCCA is a family prosperity advisor, author, property investor and Fellow Chartered Certified Accountant. He created the Four Fundamentals of Family Prosperity© a bespoke programme that helps families to retain their wealth for multiple generations.

Nicholas Charles FCCA is a family prosperity advisor, author, property investor and Fellow Chartered Certified Accountant. He created the Four Fundamentals of Family Prosperity© a bespoke programme that helps families to retain their wealth for multiple generations.